The analysis query: Do shares in VN30 basket comply with weak type of Environment friendly Market Speculation?

PART 1: INTRODUCTION

Within the funding world, portfolio administration refers to actions taken to maximise the return on a portfolio (Investopedia, 2016). Beneath portfolio administration., Environment friendly Market Speculation (EMH) is among the most essential theories that traders ought to consider in the event that they goal to earn irregular returns. This speculation mainly illustrates the connection between inventory value and out there info on the inventory, which is mirrored in three types together with robust kind, semi-strong kind and weak kind. Out of the three patterns, EMH at weak kind states that historic costs can’t be used to make predictions about future inventory costs. This analysis paper will study the weak kind EMH within the context of constituent shares within the VN30 Index – an adjusted index of VN-Index (which is the market index of Ho Chi Minh Inventory Trade, Vietnam).

PART 2: LITERATURE REVIEW

2.1 Random Stroll Principle and Environment friendly Market Speculation

The origin of inventory market effectivity will be traced again to early twentieth century when Bachelier (1900) proposed his concept about Random Stroll Speculation. This concept affirms that costs of previous, current and even the longer term haven’t any correlation; in different phrases, safety costs are inclined to comply with randomness and due to this fact are unpredictable. A couple of research round this challenge had been performed in 1930’s; nevertheless, the Random Stroll Principle was intensively mentioned within the 1960’s. Bachelier’s work was then strengthened with the introduction of Environment friendly Market Speculation (EMH) by Fama (1970). In accordance with this concept, shares at all times commerce at their intrinsic values, making it inconceivable for traders to learn from inventory mispricing i.e. buy undervalued shares and promote overvalued shares. In consequence, the one means traders can earn a better return than the market is by partaking in riskier investments.

These days, the Random Stroll Principle is known as the weak type of EMH, stating that inventory costs are random and previous occasions haven’t any affect on the present costs. In the meantime, it’s broadly identified that technical evaluation is the science of utilizing historic value patterns to anticipate future value actions. Therefore, in response to the weak type of EMH, there isn’t any level in making use of technical evaluation to foretell and “beat the market”.

2.2 Analysis research performed in the direction of Weak type of Environment friendly Market Speculation

Many research have been carried out to analyze the weak type of Environment friendly Market Speculation, a few of which fail to assist the weak-form effectivity. Srinivasan (2010) examines the validity of random stroll speculation for 2 main inventory markets in India, i.e. S&P CNX NIFTY and SENSEX, utilizing observations from 1st July 1997 to 31st August 2010. The research utilized Augmented Dickey-Fuller check and Phillips-Perron check to level out that traits of random stroll aren’t current in Indian inventory exchanges; therefore, weak kind effectivity is rejected within the case of Indian markets. In consequence, this supplies buying and selling alternatives for traders to earn irregular returns since they will make predictions about future inventory costs. Equally, Singh et al., (2016) examined the Environment friendly Market Speculation in “Carbon Environment friendly Indices” of India, the US, Japan and Brazil by utilizing Kolmogrov-Smirnov check, Shapiro-Wilk check, runs check and autocorrelation check. The outcomes from these statistical exams reveal that each day closing inventory costs don’t comply with random stroll in all nations underneath investigation. That is according to Nwidobie & Adesina (2014), who conclude that Nigerian inventory alternate shouldn’t be environment friendly in weak kind by using the GARCH autoregressive mannequin. This inefficiency, in response to Nwidobie & Adesina, could also be defined by restricted info dissemination available in the market, excessive buying and selling and floatation prices, info hoarding and insider buying and selling, in addition to poor implementation of investor safety legal guidelines within the nation. The rejection of weak kind effectivity can be present in different rising markets, evidenced by the research of Islam, et al. (2005), Srivastava (2010), BüyükÅŸalvarci & Abdioglu (2011), Haroon (2012) and Agbam (2015).

Different research, however, present proof of market effectivity in some economies. Andrianto & Mirza (2016) used each day inventory value information collected from LQ45 Index, Jakarta Islamic Index and Kompas 100 Index in the course of the interval 2013-2014 to look at weak kind effectivity in Indonesia. The outcomes from runs check and serial correlation check show that Indonesia inventory market follows weak kind environment friendly sample. Particularly, the next conclusions are drawn from the research: 1) inventory value motion is random; 2) there isn’t any correlations between the inventory value motion of the current day and former days. Andrianto & Mirza additionally recommend that traders use elementary evaluation to react rapidly for out there info, in addition to make the most of information from digital media to replace market situations. Additional proof supporting the weak kind effectivity of capital markets might lie within the findings of Jiang, et al. (2014), who examined WTI crude oil futures costs from 1983 to 2012. Utilizing bootstrapping approach, the lecturers verify the effectivity of crude oil futures market, and state that the market is inefficient solely in case of turbulent occasions, such because the oil value crash in 1985, the Gulf warfare, and the oil value crash in 2008.

2.three VN-Index, VN30 Index and VN30 shares

2.three.1 VN-Index

VN-Index is the index used as an example value fluctuations of firm shares listed on Ho Chi Minh Inventory Trade (HOSE). The issue is that, VN-Index calculation takes into consideration all shares excellent, which embody free-float shares and restricted shares. Free-float shares are shares freely out there for buying and selling available in the market (Customary and Poor’s, 2016). In distinction, restricted shares aren’t out there for public buying and selling as they’re intently held by management group, different publicly traded corporations or

authorities companies (Customary and Poor’s, 2016). In consequence, some shares corresponding to GAS, VNM, MSN, VCB and BID can largely affect VN-Index attributable to their giant variety of restricted shares.

2.three.2 VN30 Index and VN30 shares

The VN30 Index (also referred to as VN30 Equal Weight Index) was first launched to the market on February 2012, monitoring the efficiency of the highest 30 large-cap liquid shares on the Ho Chi Minh Metropolis inventory alternate in Vietnam (Phoenix Capital, 2017). This index can overcome the weaknesses of VN-Index within the following manners:

- Capitalization values of constituent shares are based mostly on the variety of shares freely traded available on the market (free-float);

- Limit the extreme affect of a specific inventory by setting the capitalization weighed restrict of 10%;

- Amongst greater than 300 shares listed on HOSE categorized into 11 main industries, shares in VN30 basket are current in 9 industries. Furthermore, shares within the VN30 basket characterize about 80% of HOSE market capitalization and 60% of HOSE market quantity (Dao, 2014).

From the benefits above, it may be concluded that VN30 Index can characterize the Ho Chi Minh market when it comes to industries, market capitalization and liquidity. This makes VN30 Index a fairly helpful funding instrument for index funds.

PART three: RESEARCH METHODOLOGY

three.1 Knowledge Assortment

This analysis paper employs the quantitative technique to analyze the weak type of Environment friendly Market Speculation within the context of Vietnamese background. The research is predicated on secondary information, that are each day closing costs of shares included within the VN30 basket. The information are collected from the database of Bao Viet Securities Firm – a well known securities agency in Vietnam.

It’s famous that the VN30 basket is periodically reviewed and adjusted each six months on January and July (Dao, 2014). For the reason that introduction of VN30 Index in February 2012, the basket has been reviewed and adjusted completely 10 occasions. For the aim of this research, not all 30 shares within the basket are chosen for evaluation. Particularly, the shares chosen should meet the criterion of being consecutively included within the basket for the previous 5 years. Put it one other means, if inventory A is included within the basket for one interval however excluded for the subsequent interval, inventory A won’t be thought-about as the thing of this research. This ensures the continuity of the information and honest remedy for all shares within the basket. In any case, solely 16 shares meet the criterion (see Appendix A for the total record of shares chosen). Their closing costs are then collected for the examined interval from 06th February 2012 (the primary day of VN30 basket) till 20th January 2017 (the top of the most recent reviewed interval).

three.2 Methodology of Evaluation

The information collected are analysed utilizing IBM SPSS Statistics software program model 20. Significantly, three exams are performed to find out whether or not shares chosen are at weak-form effectivity, specifically runs check, autocorrelation check and Ljung-Field Q statistic. The runs check is a non-parametric check that’s designed to search out out whether or not successive value modifications are unbiased. The check is predicated on the premise that if a sequence of a knowledge is random, the noticed variety of runs within the sequence must be near the anticipated variety of runs. On this context, the runs check at 5% significance degree is used to check the next speculation:

H1: Shares within the VN30 basket follows random stroll

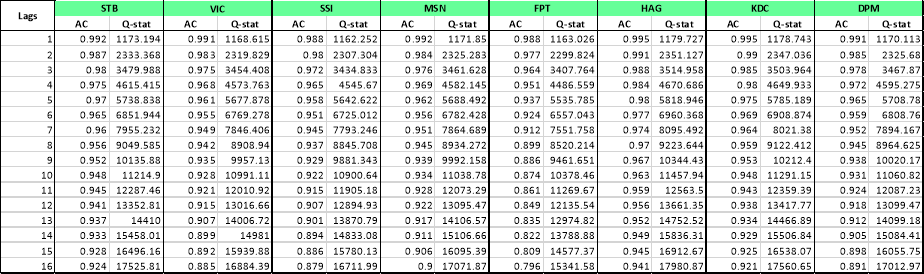

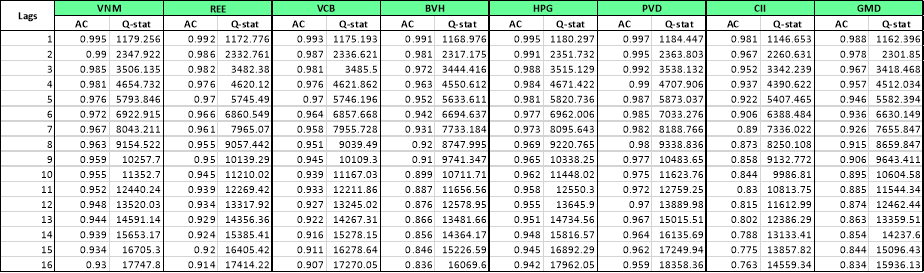

In the meantime, autocorrelation (or serial correlation) check measures the correlation coefficient between the inventory return at present interval and its worth within the earlier interval, whether or not the correlation coefficients are considerably totally different from zero. As well as, the Ljung-Field Q (LBQ) statistic examines the joint speculation that each one autocorrelations are concurrently equal to zero (that’s, the information values are random and unbiased as much as a sure variety of lags). On this context, the autocorrelation check and Ljung-Field Q statistic (at 5% degree of significance) are employed to check the next speculation:

H2: There isn’t a correlation between inventory costs of at this time and former days

Briefly, the mixture of exams talked about above assist decide whether or not 16 chosen shares within the VN30 basket follows weak-form effectivity or not.

PART four: ANALYSIS AND PRESENTATION OF FINDINGS

As will be seen from the above desk, the precise variety of runs is considerably lower than the anticipated variety of runs (whole instances), which is evidenced by destructive Z-values for all chosen shares. Moreover, it’s noticed that the numerous values across the imply of all shares are zero.000 which is beneath zero.05 (5% degree of significance). This means that 16 chosen shares don’t comply with random stroll behaviour, ensuing within the rejection of the null speculation H1 which says shares within the VN30 basket follows random stroll.

On the premise of empirical outcomes obtained from runs check, autocorrelation check and Ljung-Field Q statistic, each null hypotheses H1 and H2 are rejected. In different phrases, it may be concluded that 16 chosen shares within the VN30 basket present no traits of weak-form effectivity. The findings of the present research are in keeping with these of Truong et al. (2010), Vo & Le (2013) and Do et al. (2014) who discovered that Vietnamese inventory market is inefficient within the weak kind. Basically, the outcomes of this research contradict the Environment friendly Market Speculation (Fama, 1970) and Random Stroll Principle (Bachelier, 1900).

As famous within the literature overview, empirical research on the weak type of Environment friendly Market Speculation in rising markets have been totally examined in recent times, as in instances of capital markets in India, Thailand, Indonesia, Pakistan and Nigeria. Though these research generate blended outcomes, most of which recommend that Random Stroll attribute shouldn’t be description of those markets. This research, by investigating a case research in Vietnam, additional helps the concept of weak kind inefficiency in rising markets.

The rejection of market effectivity in Vietnam have been confirmed by quite a lot of research. It appears attainable that this inefficiency is because of gaps in Vietnamese monetary system. Non-transparency within the disclosure of knowledge, crowding impact and hypothesis are fashionable phenomena in Vietnam inventory exchanges; thus, inventory costs one way or the other don’t mirror corporations’ intrinsic values. These gaps are indicators of an underdeveloped monetary system (Fry, 1994; Leung, 2009) the place uneven info, ethical hazard and hostile choice are more likely to be discovered (Islam, et al., 2005). In consequence, traders are weak to dropping a considerable amount of cash. Moreover, as Vietnam at the moment doesn’t have a derivatives market, the funding danger will be extra extreme for traders.

Since weak-form effectivity shouldn’t be witnessed on this research, one implication of the result’s that historic information and patterns could also be used to make prediction about future inventory costs. In different phrases, technical evaluation may be employed by traders when making funding selections to assist them earn irregular returns. Moreover, as this research is predicated on each day information solely, additional analysis can check the Environment friendly Market Speculation by bearing in mind weekly, fortnightly, month-to-month, quarterly or yearly information on an extended time horizon. Alternatively, future analysis research might examine the speculation in sure industries or totally different indices in Vietnam.

four.four Limitations

As a result of nature of the analysis query, there exists some research limitations which may partially have an effect on the outcomes’ objectivity. First, due to the choice criterion, solely 16 out of 30 shares are chosen for the aim of the research. Due to this fact, it’s troublesome to generalise the findings to the entire VN30 basket since its institution. Second, precision of knowledge is questionable since some information of closing inventory costs are lacking in some buying and selling days. In consequence, this one way or the other impacts the accuracy of statistical exams in addition to their implications.

PART 5: REFLECTION ON THE RESEARCH PROCESS

At first of the analysis course of, we realized that portfolio administration is an enormous space in finance; due to this fact, narrowing down this subject was vital to our group as it will have an effect on how we might assemble particular person matters and analysis questions. Nevertheless, the acquainted subject of every was not in favour of others, which prompted conflicts in our discussions. Therefore, it was essential that we pay attention to these conflicts and arrive at an affordable compromise that’s useful to the entire group (Hede, 2007; Wu et al., 2013). Ultimately, since I had prior experiences of investing within the inventory marketplace for three years and had written a dissertation about technical evaluation, I obtained the belief from my fellows once I proposed the subject associated to Environment friendly Market Speculation (EMH). On the one hand, I felt glad to have helped my group determine the suitable subject. Alternatively, I used to be just a little bit fearful as my group members had little publicity to monetary markets. The truth is, I acknowledged that having to work on an unfamiliar space might decrease their motivation for the analysis (Boneva, 2008).

When it got here to work allocation, some critical points arose as there was no chief in our group. As a result of a lot of the workloads had been set by oral agreements with none assembly minutes, everybody was often obscure about their tasks. Moreover, our discussions didn’t work very nicely as a result of most of them occurred by way of WhatsApp group quite than face-to-face conferences, resulting in frequent distractions from social networks. I really feel these issues had been actually time-consuming and slowed down our groupwork efficiency. If I had been engaged in an analogous mission once more, I might have nominated myself because the group chief in order that I might assign workloads clearly and equally for everybody. I might have additionally recommended face-to-face conferences in an effort to have direct conversations with members. This could have introduced extra effectivity to the group when it comes to time and contributions.

One other challenge that obstructed our groupwork productiveness was dangerous time administration of my crew members. All of us had two deadlines for 2 reviews on the identical date, however whereas I devised plans to complete each of which with sufficient efforts, my companions fell into the entice of procrastination. Being rushed for 2 assignments on the similar time was undoubtedly not a good suggestion as it will negatively have an effect on the performances of each (Peper, et al., 2014). To keep away from this case, we must always have drawn up a timeline for the entire group so that everybody might successfully dedicate their time to every task.

Almost about literature search and information assortment section, some members within the group gave the impression to be passive to find articles and sharing concepts to their friends. They neither knew find out how to write an sufficient literature overview nor sorts of on-line sources they might make use of. I really feel this was partly attributable to their lack of background in finance and partly as a result of that they had by no means performed any formal analysis research earlier than. Though this aggravated the remainder of group members, we understood that this generally could possibly be unavoidable in a multicultural group. We tried to offer them as many associated articles as attainable and instructed them about skim and scan approach in an effort to decide important readings. The truth is, we must always have reported the problem to the tutor from the start of the analysis in order that these falling behind might obtain extra trainings in analysis abilities.

In abstract, this expertise has taught me helpful classes which can be fairly helpful for me in future profession, together with find out how to talk and collaborate with members in a multinational group, in addition to issues to do to turn into chief. I’ve additionally learnt extra about find out how to enhance time administration abilities, and find out how to resolve conflicts occurring throughout group works. Lastly, I feel I ought to communicate my thoughts extra incessantly sooner or later whether it is for the sake of the entire group.

References

Agbam, A. S., 2015. Assessments of Random Stroll and Environment friendly Market Speculation in Growing Economies: Proof from Nigerian Capital Market. Worldwide Journal of Administration Sciences, 5(1), pp. 1-53.

Andrianto, Y. & Mirza , A. R., 2016. A Testing of Environment friendly Markets Speculation in Indonesia Inventory Market. Procedia – Social and Behavioral Sciences, Quantity 219, p. 99-103.

Bachelier, L., 1900. Louis Bachelier’s Principle of Hypothesis. 1st ed. Princeton: Princeton College Press.

Boneva, D. L., 2008. Results of Work Ethic and Social Identification on Motivation in Teams. Illinois: ProQuest.

BüyükÅŸalvarci, A. & Abdioglu, H., 2011. Testing the weak kind effectivity of the Turkish inventory market. African Journal of Enterprise Administration, 5(34), pp. 13044-13056.

Dao, T. B., 2014. VN30 Index: An Overview and Default Likelihood Evaluation. Social Science Analysis Community (SSRN).

Do, T. T. N., Le, T. B. & Nguyen, T. T., 2014. Inventory market effectivity in rising markets: Proof from Vietnamese inventory market. s.l., s.n.

Fama, E., 1970. Environment friendly Capital Markets: A Evaluation of Principle and Empirical Work. Journal of Finance, 25(2), pp. 383-417.

Fry, M., 1994. Cash, Curiosity, and Banking in Financial Growth. 2nd ed. Baltimore: The Johns Hopkins College Press.

Haroon, M. A., 2012. Testing the Weak Type Effectivity of Karachi Inventory Trade. Pakistan Journal of Commerce and Social Sciences, 6(2), pp. 297-307.

Hede, A., 2007. The shadow group: In direction of an evidence of interpersonal battle in work teams. Journal of Managerial Psychology, 22(1), pp. 25 – 39.

Investopedia, 2016. Portfolio Administration. [Online]

Out there at: https://www.homeworkessaymarket.com/write-my-paper/investopedia.com/phrases/p/portfoliomanagement.asp

[Accessed 15 March 2017].

Islam, S., Watanapalachaikul, S. & Clark, C., 2005. Are Rising Monetary Markets Environment friendly? Some Proof from the Fashions of the Thai Inventory Market. Melbourne, Centre for Strategic Financial Research.

Jiang, Z.-Q., Xie, W.-J. & Zhou, W.-X., 2014. Testing the weak-form effectivity of the WTI crude oil futures market. Physica A: Statistical Mechanics and its Purposes, Quantity 405, p. 235-244.

Leung, S., 2009. Banking and Monetary Sector Reforms in Vietnam. Asean Financial Bulletin, 26(1), pp. 44-57.

Nwidobie, B. M. & Adesina, J. B., 2014. CAPITAL MARKET EFFICIENCY. AN EMPIRICAL TEST OF THE WEAK-FORM IN THE NIGERIAN CAPITAL MARKET. Journal of Superior Research in Finance, 2(10), pp. 164-170.

Peper, E., Harvey, R., Lin, I.-M. & Duvvuri, P., 2014. Enhance Productiveness, Lower Procrastination, and Enhance Vitality. Biofeedback, 42(2), p. 82-87.

Phoenix Capital, 2017. VN30 EQUAL WEIGHT TOTAL RETURN INDEX. [Online]

Out there at: https://www.homeworkessaymarket.com/write-my-paper/customindices.spindices.com/indices/custom-indices/vn30-equal-weight-total-return-index

[Accessed 18 March 2017].

Singh, R., Leepsa, N. M. & Kushwaha, N., 2016. Testing the weak type of environment friendly market speculation in carbon environment friendly inventory indices together with their benchmark indices in choose nations. Iranian Journal of Administration Research, 9(three), pp. 627-650.

Srinivasan, P., 2010. Testing weak-form effectivity of indian inventory markets. Asia Pacific Journal of Analysis in Enterprise Administration, 1(2), pp. 134-140.

Srivastava, A., 2010. Are Asian Inventory Markets Weak-Type Effcient: An Proof from India. Asia-Pacifc Enterprise Evaluation, 6(four), pp. 5-11.

Customary and Poor’s, 2016. Float Adjustment Methodology, s.l.: S&P International.

Truong, D. L., Lanjouw, G. & Lensink, R., 2010. Inventory-Market Effectivity in Skinny-Buying and selling Markets: The Case of the Vietnamese Inventory Market. Utilized Economics, 42(27), pp. 3519-3532.

Vo, X. V. & Le, D. B. T., 2013. Empirical Investigation of Environment friendly Market Speculation in Vietnam Inventory Market. Social Science Analysis Community (SSRN).

Wu, Okay. et al., 2013. Supporting group collaboration in Wiki by rising the attention of process battle. Aslib Proceedings: New Info Views, 65(6), pp. 581 – 604.

Appendix A: Checklist of chosen shares within the VN30 basket based mostly on the choice criterion

|

No.

|

TICKER

|

COMPANY NAMES

|

|

1

|

STB

|

Sai Gon Thuong Tin Industrial Joint Inventory Financial institution

|

|

2

|

VIC

|

Vingroup Joint Inventory Firm

|

|

three

|

SSI

|

Sai Gon Securities Incorporation

|

|

four

|

MSN

|

Masan Group Company

|

|

5

|

FPT

|

FPT Company

|

|

6

|

HAG

|

Hoang Anh Gia Lai Joint Inventory Firm

|

|

7

|

KDC

|

Kinh Do Company

|

|

eight

|

DPM

|

PetroVietnam Fertilizer & Chemical substances Company

|

|

9

|

VNM

|

Viet Nam Dairy Merchandise Joint Inventory Firm

|

|

10

|

REE

|

Refrigeration Electrical Engineering Company

|

|

11

|

VCB

|

Financial institution for International Commerce of Vietnam

|

|

12

|